You Want to Collect Art? Why Not Invest In It Too!

Art is timeless. There are few times in one’s life, which is void of the appreciation of creativity and beauty found in human artistic expression. Collecting art brings to mind many things: memories, sharing inspirations with others, even passing on something of meaning to future generations. Why, then, not consider the financial investment made when art is purchased and displayed?

Reflect on the value of the collectibles you have acquired—the potential increase in value and the returns you may receive. In Deloitte’s Art & Finance Report 2021, 85% of art collectors indicated that, along with the passion for art collecting, they took an investing view of the acquisition. In fact, the theory of investment value continues to be a motivating force among collectors. In our changing economy, the diversification achieved by the inclusion of art and other collectibles in a wealth portfolio is indicative of a more financially educated clientele.

- Art & Finance Report, 2021. Delloit.com

Where are the Advisors?

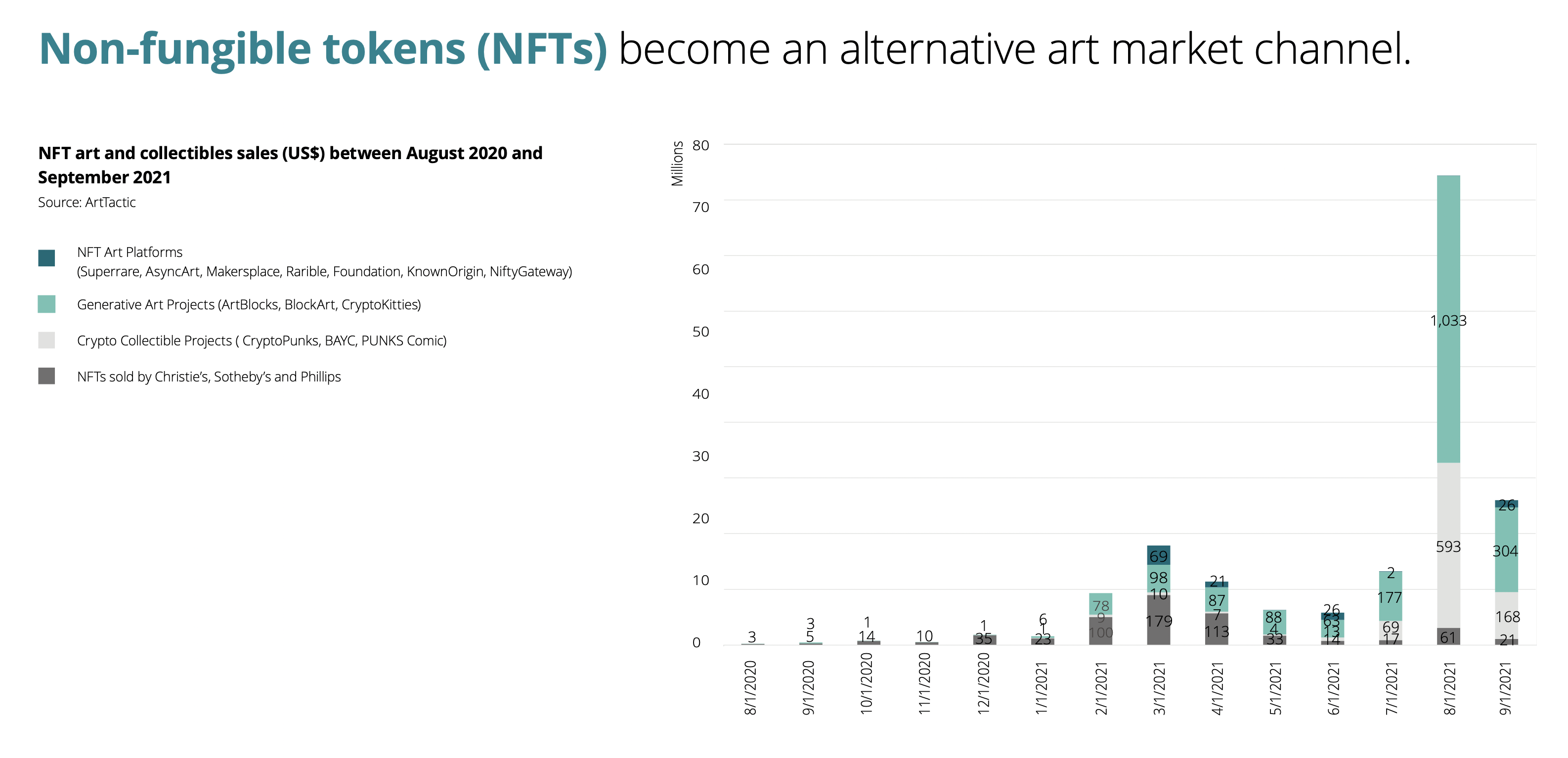

Wealth managers have not historically been knowledgeable about art/collectibles as part of a management offering. However, in the past five years, the tides have been turning and financial advisors are realizing the value of adding this to their industry. Still, many remain cautious about the future of “art investing.” Institutions which have previously offered services in estate planning and philanthropy are best suited to manage art investing. As more education and training for financial professionals is offered, there will be an increase of options for those looking for art and collectible investment advisors.

Lending—for Art?

A relatively new aspect of art investment lies in lending. Wealth-managing institutions are starting to offer art-secured lending as the demand rises. The US market is particularly strong due to low-interest rates and a growing interest in art collection as a whole. Millennials are uniquely poised to increase art lending, as they typically lean towards financial activities, which align with their passion and interest.

Future Markets

An unorganized market is not prepared to continue and gain both stability and popularity. The challenge of balancing the desires of art investors to have a more traditional commercial financial market with the creative, unique and personal taste-driven art market is not underappreciated. Several suggestions have been brought forth, and progress has been made in areas like standards for art market professionals, strengthening of government enforcement of existing laws, reinforcing the necessity of professional, legal behavior in art and collectibles sales, and improving the relationship between art professionals and wealth management representatives.

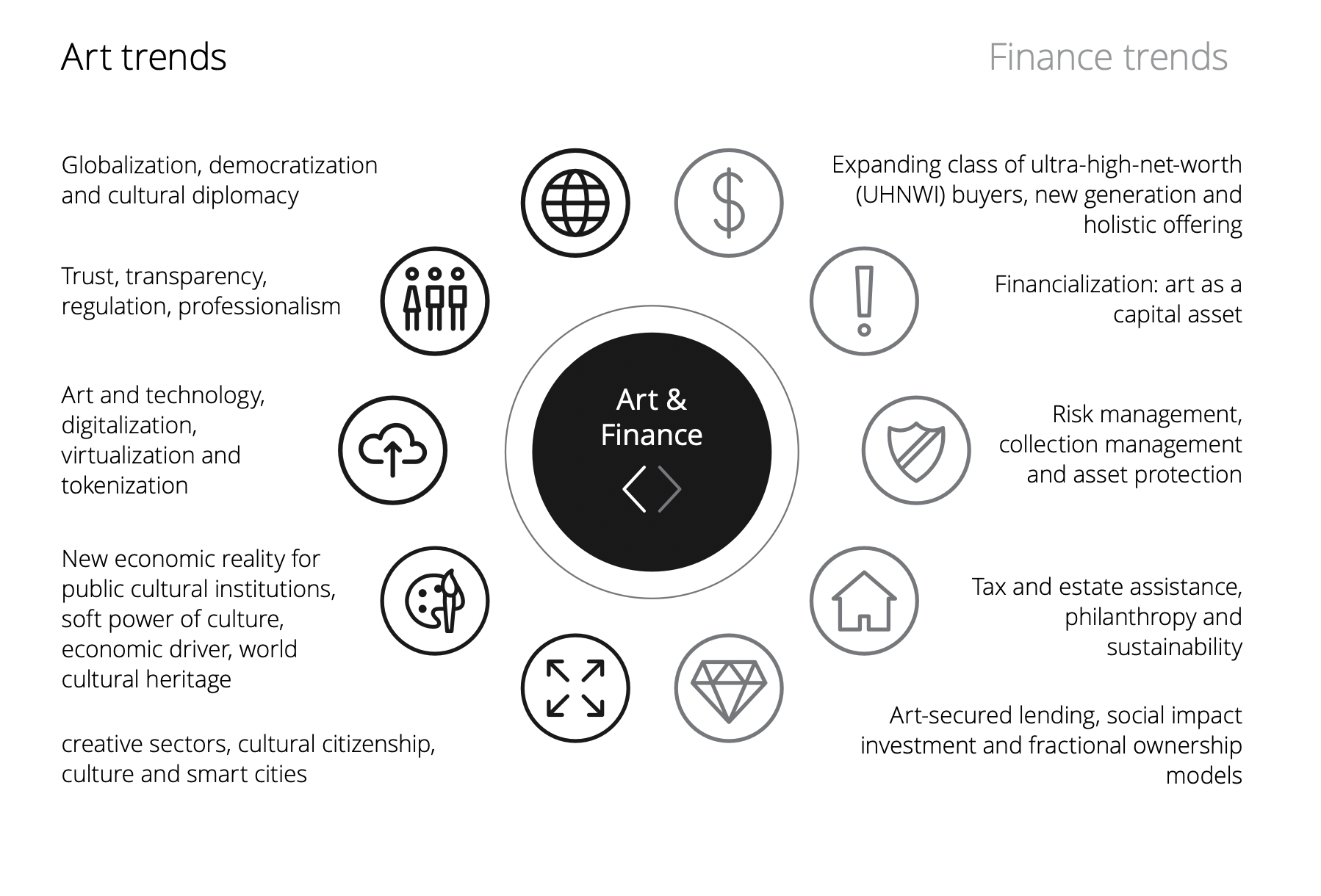

The Alternative Art Market: NFT’s

According with the 2021 Art & Finance report by Deloitte: “Sotheby’s, Christie’s and Phillip’s only only auction sales broke through US$1 billion for the first time, ending up at US$1.05 billion in 2020, up from US$168.2 million in 2019”. However, with the boom of the NFTs that we witnessed in 2021, the art market has facing a new alternative market which goes beyond the online sales. Non-fungigle tokens increase their value in almost 90% from august 1st 2020, with US$3 millions in sales, to agust 1st 2021 with US$1,033 million. The NFT’s wich major sales are those focused on that market. That is to say, even when the popular auction houses such as Sotheby’s, Christie’s and Phillip’s has approached to the NFTs sales, the highest investment gains are held by generative art projects such as ArtBlocks, BlockArt and Cryptokitties.

- Image Source: Art & Finance Report 2021 by Deloitte.com

What This All Means for New Collectors

When considering art investing, look for advice. Art professionals and financial managers may have different perspectives on this type of activity, and both points of view should be respected. Since art prices are unpredictable and trends may change (just like any other financial market), first and foremost choose something you enjoy. Art investing is a two-sided coin, with both the investment and enjoyment equally valuable. Following your local art scene, or even focusing on a single artist you like, is a good place to begin. Think about display, storage, and even insurance. Get advice on how much of your portfolio to put in art; 2.5 to 3% is a common amount. Follow markets, so you know when the time is right for buying and selling. Finally, build relationships with people whom you trust and can provide some guidance over time. With our experience in art travel and history of discovering new and exciting talent, let the experts at Sybaris help you find that perfect investment, one which inspires you as it increases in value! Where else will you find an investment you can view and appreciate every day? Although not a quick turnaround scheme, our unique and imaginative pieces can be a valuable addition to your wealth portfolio!

- Image Source: Art & Finance Report 2021 by Deloitte. https://www2.deloitte.com/lu/en/pages/art-finance/articles/art-finance-report.html